R&D Tax Credit

Endeavor Advisors is a tax consulting firm that was founded by Steven Jefferies and a group of partners that have extensive experience in analyzing, calculating, and implementing research and development tax credits for small and medium businesses nationwide. Steven obtained his law license from the University of Houston Law Center and has diligently assembled a group of tax professionals and associate CPAs to proficiently handle IRS Federal R&D tax credit filings while safeguarding client interests.

Endeavor specializes in providing a comprehensive, turnkey research and development tax credit solution by guiding you through every stage, starting from the initial qualification call and credit estimation, all the way to quantifying and filing your R&D tax credit with your existing CPA. We offer pro-forma forms for your federal and state filings and complete the process by delivering an inclusive final report that meticulously documents each step that was completed for your business. We streamline the tax credit process by working directly with your CPA or accounting team to be sure your R & D tax credit is maximized.

Since 2020, we also provide consulting services for calculating and filing Employee Retention Credits (ERC). We are often approached by business owners requesting our assistance in filing corporate R&D tax credits or Employee Retention Credits that they previously managed in-house. More often than not, Endeavor R&D Tax Credit Advisors discovers that these taxpayers have been under-utilizing the credits they are entitled to. Also, we often find that the supporting evidence and documentation for these R D tax credits tend to be inadequate, leaving taxpayers potentially exposed to liability.

Research and Development Tax Credit Compliance

When claiming and filing IRS research and development tax credits, is critical to consult an expert to ensure that your R&D documentation complies with the laws and regulations that have been set in place by the relevant federal or state governing body. We are meticulous in our R&D tax credit calculation and supplying supporting documents to safeguard our clients’ interests.

In addition, Endeavor offers industry-pioneering flexible fee models. Through our work with hundreds of clients, we are able to incorporate efficiencies of scale, offering sliding scales and decreasing fee schedules for multi-year work. Endeavor is also pioneering an industry-disrupting technology to automate the R & D tax credit process, which we plan to launch in 2024.

We work with clients in technology, software & blockchain development, brewing, winemaking, distilling, engineering, government contracting, architecture, agriculture, and many other industries. Contact us today for a free estimate of your R&D tax credits!

What are R&D Tax Credits?

R&D tax credits, also known as Research and Development tax credits, are a government incentive signed into law in 1981 that are designed to encourage businesses to invest in research and development activities. In addition, the R & D tax credit incentivizes employers to create and keep technical jobs on U.S. soil. These credits provide large financial benefits to companies that engage in qualified R&D activities by reducing their tax liability.

The tax laws regarding the specifics of R&D tax credits vary from state to state, as each state government has the power to implement and enforce their own tax rules and regulations. In general, these tax credits are based on eligible R&D expenses incurred by the company, such as wages for R&D personnel, costs of supplies and materials used in R&D projects, and expenditures related to contractors or consultants.

The purpose of R and D tax credits is to promote innovation, technological advancement, and economic job growth. By providing financial incentives, governments aim to encourage businesses to invest in R&D projects that can lead to the development of new products, processes, software, and improvements to existing offerings. The program that has proven to be highly successful in many different industry sectors.

How do R and D Tax Credits Work?

With the help of a professional, companies can typically claim R&D tax credits by documenting and substantiating their eligible R&D activities and expenses. The credits are applied as a reduction in the company’s tax liability, either by directly offsetting the tax owed or by providing a refund for any excess credits. The federal R&D credit calculation is very specific and takes into account a variety of factors relating to the businesses operations and expenditures in accordance with the laws of the state where the business operates.

Each year, you can generate an R&D tax credit by incurring expenses related to wages, supplies, and contractors. This credit enables you to recoup approximately 10% of your yearly research and development expenditures. Notably, these credits can be utilized on your tax returns from the past three years, while any remaining R&D credits can be carried forward for up to 20 years into the future.

R&D tax credits can be extremely valuable for businesses of all sizes, from startups to large corporations, as they help offset the costs associated with research and development, making such investments more affordable and economically viable while remaining focused on innovation and growth.

In addition, in a great new provision to the federal tax code, R&D credits can now be used to offset up to $250,000 in payroll tax liability annually. This provision is intended for start-up companies in their first 5 years of revenue. Such companies are often not yet profitable, yet they have tax liability based on their payroll. Research and development credits can help reduce payroll tax liability in this critical early stage of start-up development. Once a company evolves into profitability, the credits can be used to offset income tax liability as normal.

At Endeavor Advisors, we possess the experience, industry knowledge, accounting proficiency, and legal expertise required to provide our clients an efficient and effective solution for properly maximizing R&D credits.

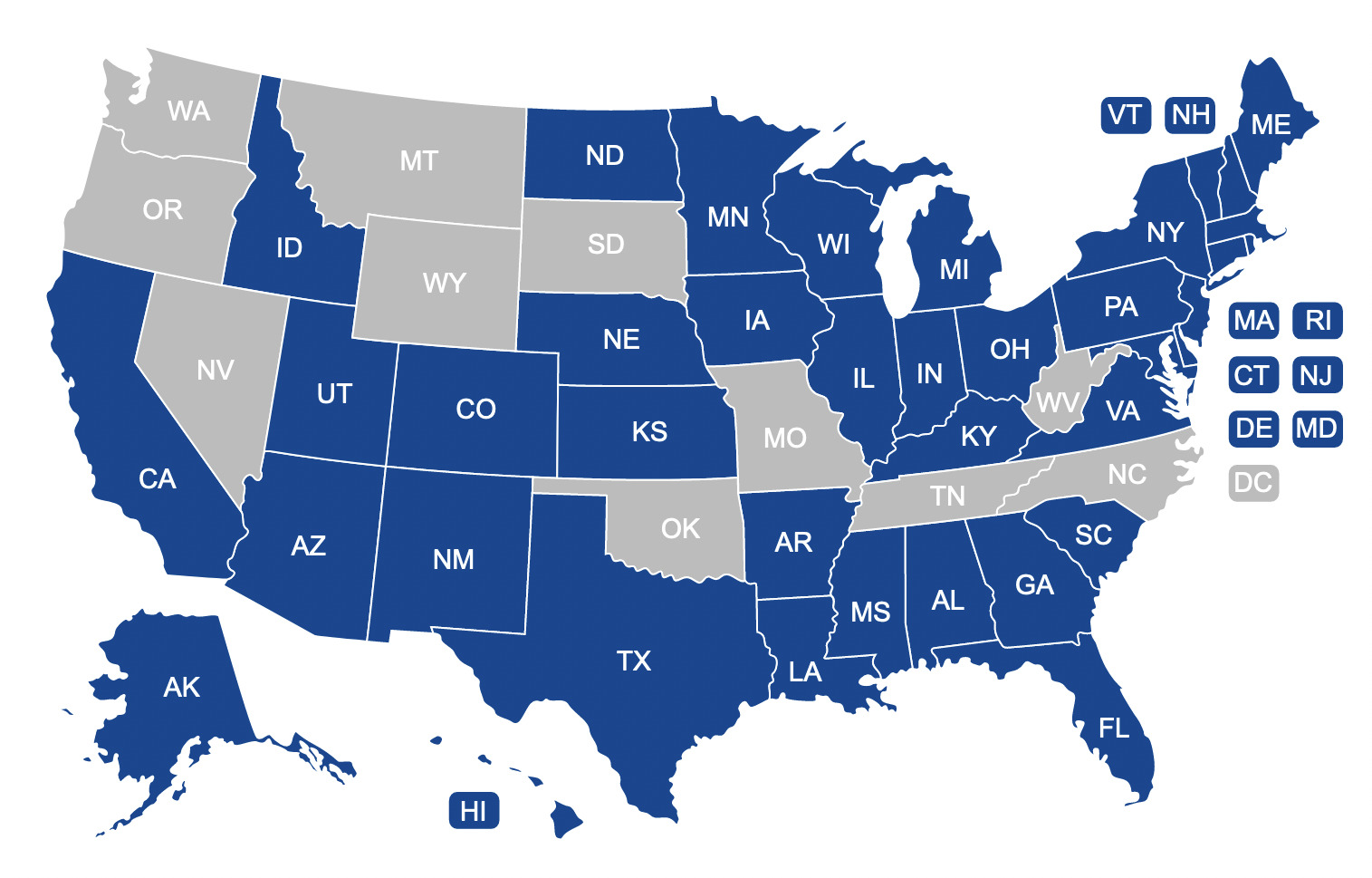

Which states qualify for R&D tax credits?

Currently 38 states qualify for R&D tax credits while 12 states do not. Check to see if your state qualifies.

This page was last updated by Steven Jefferies

Would you like to speak to one of our R&D tax credit advisors over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.